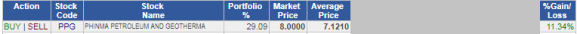

Two tales of trades: PXP vs IDC

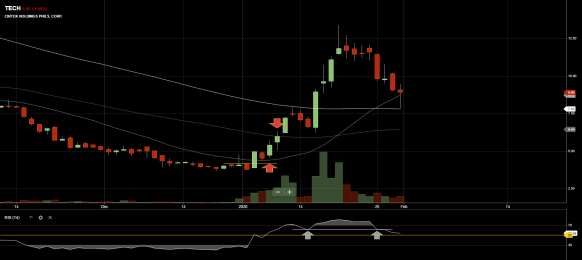

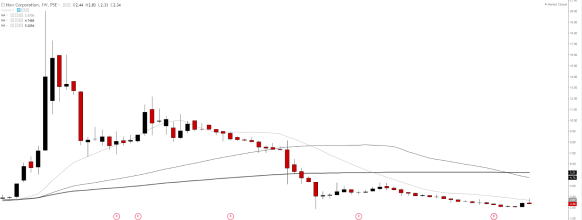

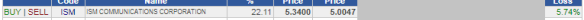

IDC Trade

Entry: 5.81 (Ideal 5.80)

I wasn’t able to grab the piece on breakout but I got a little lucky to catch on the pullback the next day.

Exit strategy: Variable (Breakdown, Target price, or Weakness on resistance)

On a bigger scale, IDC was able to pierce F38 which was a good sign of strength. My bias was it would eventually create a Darvas box which could possibly run for another breakout on to the next golden ratio (F62).

Unfortunately, it broke down to the previous Darvas line (red line around 6.50) which triggered my sell button.

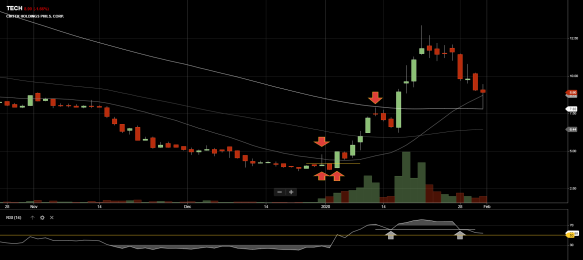

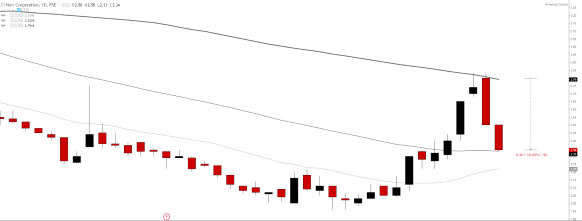

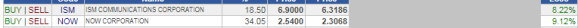

PXP Trade

Entry: 9.40 (Ideally 9.30)

The breakout was quite fast. The day close had given me a good base to hold on.

Exit strategy: Variable (Breakdown, Target price, or Weakness on resistance)

My bias was that price would eventually close the gap. Unfortunately, the price had shown hesitation near the target area which was 12.00-12.20. F38 was pushing back the price. I didn’t hesitate to lock in a decent profit.

Same play, same strategy, and both were breakout triggered.

I could have locked in those profits in IDC yet I made have missed a bigger move according to my bias. Nevertheless, the important thing was I followed my plan though I wasn’t able to maximize my profit still I’m satisfied. Perhaps I would consider refining it to get far better in securing my profits.

PXP was fine even though it pushed a little more the next day still I was able to secure a nice chunk of profit.

At the end of the day,

he who profited and had gained knowledge wins.