It was hard for a novice to even know that there’s a greater challenge lies ahead of them.

The battle between you and yourself.

The fight to change own self to become a new version of you, the real trader you. Being a profitable trader doesn’t mean you have to be the “Einstein of indicators” or “a guy who knows it all” whenever you are in a debate or discussion. Trading per se doesn’t work that way.

Over the years I’d experienced the worst that I couldn’t imagine when I begun trading in stock market. Some of those struggles I’ve faced were impulsiveness and over-trading.

2 years ago, I was in a live web chat of some traders who use troll accounts. The interviewee was a good trader in my opinion because I’ve always followed and studied his trades where I’ve seen quite amount of substantial idea in how he trade. One of the question I threw that time was:

“What makes you get into a position”?

and the answer was,

“I simply wait for the proper setup to appear before I get in”.

Well, I am a patient person. I can wait more than an hour doing nothing while my wife:

- my wife does her stuff in mall

- dressing up

- before we leave

- I was born to do this!

I love my wife so much.. ;P (peace)

Going back, If patience was the key I should’ve performed well in trading right? Time flies fast, I made a lot of ugly trades. I wasn’t good enough though I “patiently” waited and waited.

*Fast forward to present*

As I made a lot of new friends in trading, sharing knowledge and trades of course happens all the time. As my success trades started growing, I’ve noticed they also start telling me, I have good “Patience”. They hoped that they’ll come to the point like the level where my patience is.

Actually, I suddenly got interest in finding answer to the phrase. Am I really patient now?

What is Patience?

The capacity to accept or tolerate delay, problems, or suffering without becoming annoyed or anxious.

Patience of knowing

It’s very simple yet powerful act which a trader with good knowledge and experience would understand. In the world where hot money move in one place to another in a very fast phase, a trader may get wiped out in just a minute or even seconds the moment they jump in. To “simply wait” was one of the powerful rules that I’ve ever learned over a long period of time. I’ve learned patience by studying the pros/cons, in/out, dos/don’ts, or this/that of my strategy. It enabled me to get a clear picture on how it should be done correctly. From that point, I knew how I would execute my plan and the specific signals I should be waiting for to trigger the buttons. Patience isn’t just about waiting but knowing when to pull the trigger in the right time.

On the other perspective, patience “in trading” isn’t only about the phrase “the discipline to wait” rather it can also be seen after the entry – “the patience in execution”. Patience doesn’t end after you’ve waited and pressed buy. It will only end once you’ve finally exited.

- impulsiveness

- chasing

- fomo

- superman

I never would have imagined that the interviewee would become my mentor. 😀

Patience is learned

I’ve been told that in bear market that I should be more careful and be more objective in terms of profits. When I was still suffering from consecutive losses, I didn’t had what I call “the feel” or “right sense” about the market cycle which made my losses pile up. Understanding how the market cycle works as well as learning more in my niche had given me a substantial knowledge where I learned how to patiently wait and trade on the right market status.

Patience isn’t only found in ourselves naturally rather it can also be learned. In my point of view, I became patient because I knew what’s going to happen if I pushed myself to trade blindly. Therefore, patience is knowing when to execute or put everything at bay.

Patience as discipline

Patience in the long run means sticking with your strategy long enough to produce long term results. Managing small goals each week/month extending it over a year against looking for that “ONE BIG TRADE” is more achievable and the right way to do it. Never I was successful going ALL IN on every trade. Since the market plays in a random principle of distributing wins and losses my 25% success rate won’t take me to anywhere if I expose my funds too much. Planning and sticking up in a long term goal helped me to be more structured. It eased out the pressure from having a huge loss.

- Gambling mindset

- revenge trading

- makabawi syndrome

Comparing myself with present me have quite significant differences. I learned that PATIENCE isn’t just found as a natural trait rather it can also be learned through our experiences added with the right information.

A friend told me recently that I’m patient with my trade and was able to prevent myself getting whipsaw with some trade. I suddenly remember my old self. The time when I was really struggling with my progress (I guess if you’re able to read my previous posts you know what I mean). The most important thing that I thought had given me the “patience” they told me was “studying, experiencing, and mastering the technicality of my strategy”. It’s knowing how to play the game.

Let me explain what I mean. You are playing with a friend, a silly friend, and he told you it’s your turn to jump over him, how would you likely do it?

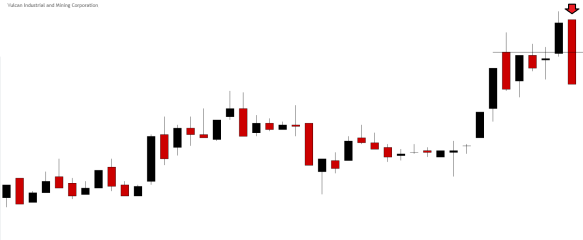

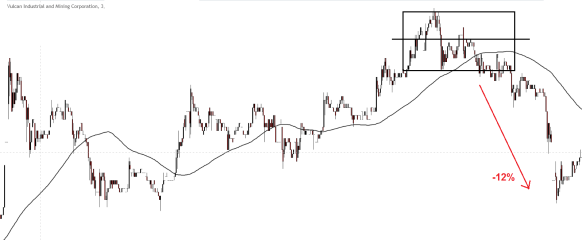

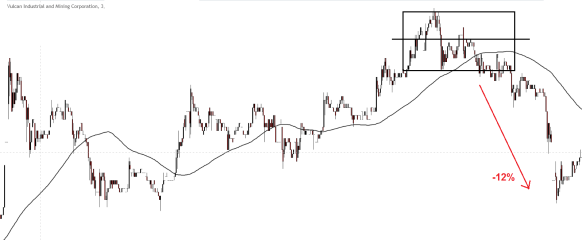

Just for reference, this was VUL 24-Oct-18.

They were amazed that I was able to “predict” VUL drop like this, “Ang galing ko daw” I said nope that’s not really the case for me. Anyway, this was the story.

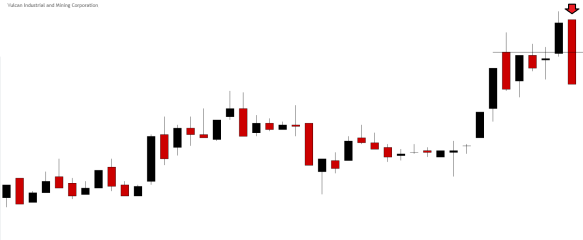

Those times VUL was a talked of the town since it’s trading around ATH levels. This was how VUL looked like that day in 3 minutes chart.

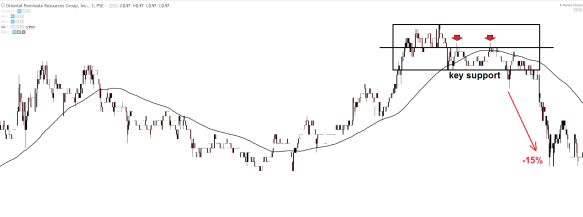

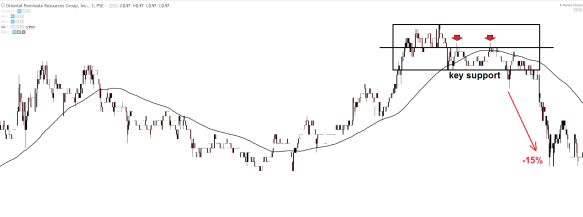

I told them that I’ve seen a similar chart structure before. This was ORE 12-Jul-18.

In my brief analysis, it’s trading at 52 week high with more than 15% volatility rate. It failed to show strength by not breaking out from those 2 red arrow mini-resistance at 50% darvas level. Followed by a violent breakdown from the current box. ORE fell a very violent drop sucking up more than -15% in minutes.

Going back with VUL which was trading at ATH level, in my analysis, if the price action won’t show strength by breaking out on the red arrow mini-resistance plus a strong breakout over the box top, there “could be” a greater possibility that a breakdown would happen. Here is the point, if the breakdown occur it COULD drop very violently. I use the word “could” I don’t if it really would happen.

There you go! Abandon ship!

I’m not claiming anything about this study. I didn’t actually knew that this will happen. What I did was just I compared a previous chart structure and analyze the “possible” scenario. By doing these, I was able to save myself from a higher chance of losing.

That day I watched VUL play out and the worst thing had happened. That’s how they were amazed about me being patient. In my thoughts, It’s not about patience what I’m talking about here rather the knowledge I had with the similar price pattern where I had an idea of what’s going to happen. Why bother if I knew what I was waiting for? My analysis told what I needed to know on what may lie ahead and this suppressed my eagerness as well as my impulsiveness.

To my friends whose suffering from their impatience and impulsiveness, take time to study more about the dynamics of your strategy and setups. The more you learn about them the more you see yourselves getting patient. Cause I too have been in that situation where I was too eager to grab a piece of the action and ending up beaten not only financially but also emotionally. FOMO is a result of not knowing what’s happening without having a specific plan and trying to earn with the help of a unknown force, feeling/emotion.

Cheer up and be patient to learn more before face another challenge!